Red Rock Financial Services is the leader in collection services for Community Associations in Nevada. Red Rock is a collection agency fully licensed where required, and in full compliance with collections laws, providing collection services to Community Associations through the non-judicial foreclosure process. We have years of experience in collecting assessments for Common-Interest Communities, with a strong focus on customer service and client relations. All services are provided with no up-front fees and at no cost to the association.

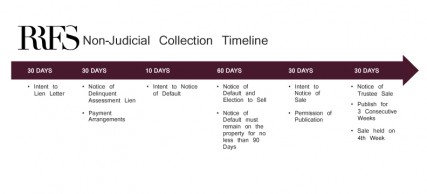

Non-Judicial Foreclosure

Nevada allows a non-judicial foreclosure process. Under the non-judicial foreclosure process, a foreclosure can be completed outside the court system based on power of sale given to a trustee.

COLLECTION PROCESS

Step 1: Board the Account

- The delinquent balance will be reviewed to determine if the delinquency is due to assessments or late fees and fines.

- Ownership will be verified via the County Assessor’s Web Site.

Step 2: Intent to Lien Letter

An Intent to Lien Letter is mailed certified and first class mail to all known addresses. The letter informs the homeowner of the following:

- This gives the homeowner 30 days–or whatever period is specified by the HOA’s collection policy– to reinstate the account before the Notice of Delinquent Assessment Lien is prepared and recorded.

- Informs the homeowner that an additional fee may be charged if they do not pay within the specified time period.

- Informs them of their right under Federal Law to dispute the validity of the debt within 30 days of the original notice.

Step 3: Notice of Delinquent Assessment Lien

- A Notice of Delinquent Assessment Lien is prepared and recorded. A copy of the Lien along with a cover letter is mailed certified and first class mail to all known addresses. The cover letter explains the following:

- Informs the homeowner that their right under Federal Law to dispute the validity of the debt is still in effect.

- The homeowner is given the option of alternative payment arrangements.

- The Lien must be mailed and remain on the property for a minimum of 30 days before the Notice of Default may be recorded

Step 4: Intent to Notice of Default

- An Intent to Notice of Default letter is sent to the homeowner. It informs them of the following:

- Informs homeowner to reinstate the account within 10 days from date of letter.

- Informs the homeowner that if no contact is made with Red Rock within 10 days from the date of the letter, the Notice of Default and Election to Sell will be prepared and recorded.

- Informs the homeowner that an additional fee will be charged if they do not pay or contact our office within 10 days.

- The homeowner is given the option of alternative payment arrangements.

Step 5: Notice of Default and Election to Sell

- A Notice of Default and Election to Sell is prepared and recorded. Within 10 days of the recording date, notice must be mailed via first class and certified mail to all known addresses as well as all addresses provided by the title company listed in the Trustee Sale Guarantee (TSG).

- The Notice of Default must remain on the property no less than 90 days after the recording of the Notice of Default before a Notice of Trustee Sale can be scheduled.

Step 6: Intent to Notice of Sale

- An Intent to Notice of Sale letter is sent to the homeowner. It informs them of the following:

- Informs the homeowner that 60 days into the 90 day waiting period have lapsed.

- Informs the homeowner that an additional fee will be charged if they do not pay or contact our office within 30 days from the date of the letter.

- The homeowner is given the option of alternative payment arrangements.

- A letter is mailed first class to all known mortgage holders. The letter informs them that the Association’s foreclosure sale is imminent and that their positions might be in jeopardy.

[/toggle_content]

Step 7: Final Notice

- A Final Notice, sometimes referred to as the Intent to Conduct Foreclosure letter” is mailed to the homeowner no less than 90 days after the recording of the Notice of Default.

- Informs the homeowner that we have made several attempted to contact the homeowner.

- We are scheduled to prepare the account for foreclosure.

- Homeowner has 10 days to contact our office before the Notice of Sale is recorded.

Step 8: Notice of Trustee Sale

- Notice of Trustee Sale is mailed first class and certified to all known addresses as well as any additional addresses or names listed on the TSG. The notice advises the homeowner of the imminent foreclosure sale.

- Notice of Sale is published in an authorized publication for 3 consecutive weeks.

- The Notice is posted on the property.

- Information for the Ombudsman is provided on the Notice of Sale per NRS.

- On the 4th week a board member, preferably the President, or the Community Association Manager, with the Board’s approval, must sign the final permission to go forward with the sale.

- The sale is held at the County Court House Steps at its designated time and day.

- The property can revert to the Association, meaning there are no bidders and the Association takes possession.

- The property can be sold to a third party bidder and a new owner takes possession.